The banking market: turmoil and increased demand. No panic

Commentary by InfoMarket Agency

On the first day of hostilities in Ukraine, the National Bank of Moldova (NBM) published a message stating that "the Moldovan banking sector remains stable, strong and steady, banks are working as usual".

But are there preconditions that something could go wrong? At the end of its message the regulator stresses that it is "closely monitoring the situation from a broader perspective and is ready to take necessary measures to mitigate risks and uncertainties according to its authority".

Some risks have indeed manifested. As one banker, with whom the InfoMarket correspondent spoke, noted, in an uncertain situation, our population applies a standard set of actions: "stock up on groceries, fill up a full tank of fuel and buy some euros."

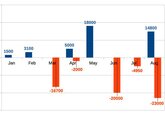

And this time there were no particular exceptions. Since the morning of Thursday, February 24, at the offices of almost all banks there were queues of individuals. Most of them wanted to withdraw their deposits in lei (MDL) and buy foreign currency. It is popularly believed that this will save savings, although, on the other hand, it is precisely such actions that fuel the excitement.

We have noticed a similar situation in the first days of the quarantine in 2020. But then, after a week, the MDL exchange rate has strengthened and the hapless depositors handed back the currency in tears and complained about the "injustice of life and negligence of the rulers.

This time the demand for breaking deposit contracts was less than two years ago. Bank officials managed to convince some customers not to take hasty action, especially since the atmosphere in the banks of Moldova was working, without nervousness, if not to count the unusually large number of customers who came.

On Thursday, some ATMs "surprised" customers with the announcement "out of cash", but only those located in crowded places, and where bank employees could not keep up with the cash replenishment cassettes.

A similar situation was noticed in some currency exchange offices, including bank ones, since demand exceeded supply, not everywhere they could meet the demand immediately and completely. But it was only a question of the influx of currency buyers and the same logistics of "replenishment" - a process that requires certain procedures and time against a background of increased demand. Increased, but not frantic.

The non-cash market, as noted by its participants, has recently experienced some shortage of currency, which, however, was closely monitored and regulated by the National Bank. Information from Ukraine made economic agents nervous and some of them decided to buy hard currency. This, by the way, was reflected in the exchange rate: the MDL depreciated by 0.48% against the U.S. dollar on Thursday, which is a bit beyond the usual volatility.

As InfoMarket has already noted, exports to the East will suffer one way or another, as will part of the currency inflow to Moldova from there. Our country's share of exports to CIS countries in recent years is not insignificant, but still it is not critical: 14.8% in 2021.

The country has enough foreign currency in cash. Even despite the temporary closure of Moldova's airspace, we have other borders with the European Union. The Central Bank notes that the banking sector of Moldova has sufficient liquidity to ensure the continuity of its normal operation.

For the banking sector the risks in this regard may manifest with borrowers from the eastern markets: the situation may have a negative impact on their timely payments. Probably, some will be able to apply the force majeure provisions and revise their payment schedules at least towards deferral. But it depends on each bank individually.

Another risk is related to the psychological factor: the payment discipline of clients might fall in relation to repayment of credits, especially in cases of individuals. Even if they will receive their income on time in the same amount: salaries or transfers, people may prefer to put them in a stash, hoping that, like two years ago during the quarantine, the government will persistently ask the lenders either to delay payments or not to charge penalties.

Overall, the NBM notes that "the current level of reforms and modernization of the banking sector allows its further development in options to harmonize with the standards of financial services in the world. Also, our country has sufficient foreign currency reserves which could be used in possible crisis situations to ensure financial stability".

Indeed, Moldova's banking system of 2022 is not the banking system of 2014-2015. Today all banks of the country, except for one, are owned by foreign shareholders, mostly system investors. All shareholders are known and verified, which means that we should not expect any "unclear operations" as it was seven years ago.

Settlements with Russia (for example, for gas) even if this country is disconnected from the international payment system SWIFT, will continue through alternative routes. For example, in 2019, Europe created the INSTEX system specifically for settlements with Iran, which is under U.S. sanctions. Even earlier, in 2015, when China was disconnected from SWIFT, this country created its own CIPS system, which may well be made available to Russian banks. And the currency of payment can be replaced by the Russian ruble, a possibility also provided for in the current contract with Gazprom.

Among the problems the country may face in this difficult period are the influx of refugees and the issues of uninterrupted supply of energy resources, rising prices for food and medicines (including speculative ones). But this already exceeds the authority of the banking regulator, which ... "is closely monitoring the situation from a broader perspective and is ready to take the necessary measures to reduce risks and uncertainties in accordance with its authority." // 25/02/2022 - InfoMarket.