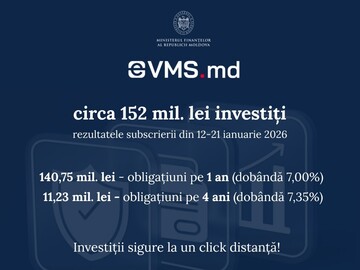

In Moldova, during the first in 2026 individual subscription to government securities through the eVMS.md platform, nearly 152 million lei was invested in government bonds

The Ministry of Finance reported this, noting that 2026 began with heightened interest in secure public investments. Specifically, from January 12 to 21, citizens invested 151.98 million lei in government bonds through the eVMS.md platform, confirming continued interest in this accessible and effective savings instrument. During the subscription, investors placed their savings in bonds tailored to various financial goals. The largest portion of the investment—140,753,900 lei—was directed toward bonds with a one-year maturity, offering an annual interest rate of 7%. Meanwhile, bonds with a maturity of four years at 7.35% per annum attracted 11,226,100 lei. The Ministry of Finance reminds that government securities are issued monthly, providing the public with the opportunity to continuously invest on favorable terms. The interest rate is fixed and tax-exempt, and payments are made twice a year directly to investors' bank accounts. The next subscription sessions are scheduled for February 9-18 and March 9-18. Up-to-date information on the subscription results, the issue calendar, and participation conditions is available on the eVMS.md platform and on the Ministry of Finance website. It was previously reported that Moldovan individuals invested over 525.3 million lei in government bonds on the eVMS.md platform in 2025, including over 51.5 million lei during the last subscription of the year in December. In 2025, 10 bond placements with maturities ranging from 1 to 4 years were conducted through the eVMS.md platform. These placements were attended by 2,131 investors, and the total volume of investments attracted amounted to 525,332,800 lei. // 22.01.2026 – InfoMarket.