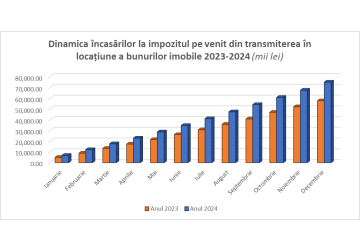

Revenue to the Moldovan budget from the payment of income tax by individuals renting out real estate in 2024 increased by 30.1% - up to 74.9 million lei, compared to 2023

The State Tax Service (STS) reported this, noting that as a result of actions of voluntary compliance and informing, 2303 individuals renting/using real estate were identified in January-December 2024. For 305 individuals who rented out real estate and did not comply with the legislation, the following payments to the budget were additionally charged: basic payments - 557,500 lei, penalties for late payments - 60,500 lei and fines - 28,200 lei. A total of 26086 contracts for leasing real estate to other individuals were registered with the STS in 2024, which is 5.3% more than a year earlier. The STS reminded that according to the Tax Code, individuals who are not engaged in entrepreneurial activity, renting real estate to other individuals for possession and/or use (property rent, lease, usufruct), pay a tax of 7% of the monthly value of the contract. These persons are obliged to register the contract with the State Tax Service within 7 days from the date of its conclusion. This tax is paid monthly, not later than the 25th of the current month, in accordance with the procedure established by the State Tax Service. Citizens who do not fulfill these obligations are fined in accordance with the Tax Code. Also, the STS reminded individuals who are not engaged in entrepreneurial activity and who transfer real estate into possession and/or use to other individuals using Booking, Airbnb and other platforms about the need to fulfill tax obligations related to the income received. // 17.01.2025 - InfoMarket.