Capital market

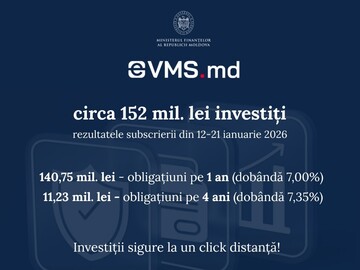

In Moldova, during the first in 2026 individual subscription to government securities through the eVMS.md platform, nearly 152 million lei was invested in government bonds

22.01.2026

The Ministry of Finance reported this, noting that 2026 began with heightened interest in secure public investments. Specifically, from January 12 to 21, citizens invested 151.98 million lei in government bonds through the eVMS.md platform, confirming continued interest in this accessible and effective savings instrument. During the subscription, investors placed their savings in bonds tailored to various financial goals. The largest portion of the investment—140,753,900 lei—was directed toward bonds with a one-year maturity, offering an annual interest rate of 7%. Meanwhile, bonds with a...

/

full text